| رمز الشركة | نسبة التغير | عدد الصفقات | السعر الوسطي | حجم التداول |

|---|---|---|---|---|

| BBSY | 4.95 | 755.50 | ||

| CHB | 4.84 | 536.04 |

| رمز الشركة | نسبة التغير | عدد الصفقات | السعر الوسطي | حجم التداول |

|---|---|---|---|---|

| AVOC | -1.99 | 369.50 | ||

| SIIB | -1.93 | 507.00 | ||

| QNBS | -1.89 | 307.02 |

| رمز الشركة | قيمة التداول | نسبة التغير | السعر الوسطي |

|---|---|---|---|

| AVOC | -1.99 | 369.50 | |

| SIIB | -1.93 | 507.00 | |

| QNBS | -1.89 | 307.02 |

مؤشر سوق (DWX)

الشركة

بيمو السعودي الفرنسي المالية هي شركة وساطة مالية مرخصة من قبل هيئة الأوراق والأسواق المالية السورية، تتركز أعمالها على تقديم الاستشارات المالية والوساطة وإدارة الأصول بما في ذلك إدارة محافظ الأوراق المالية وإدارة الإصدارات.

تتبع الشركة لبنك بيمو السعودي الفرنسي، البنك الخاص الأول والرائد في سورية وتم تأسيسها بناءً على التشريعات التي صدرت ومهدت الطريق أمام إقامة سوق للأوراق المالية في سورية.

برأس مال وقدره 300 مليون ليرة سورية، تأسست شركة بيمو السعودي الفرنسي المالية عام 2008 وحصلت على أمر المباشرة من قبل هيئة الأوراق والأسواق المالية السورية بموجب القرار رقم 23 بتاريخ 21 نيسان 2008. بالإضافة إلى ذلك، مُنحت بيمو السعودي الفرنسي المالية العضوية رقم واحد في مركز المقاصة والحفظ المركزي لتتواجد الشركة في أول يوم للتداول (الافتتاح الرسمي لسوق دمشق للأوراق المالية) وتقوم بتنفيذ أول عملية تداول في السوق بتاريخ 10/3/2009.

الالتزامات

تلتزم بيمو السعودي الفرنسي المالية بأن تصبح المرجع الريادي لكل ما يتعلق بالخدمات المالية والاستثمارية في سورية من خلال تحقيق ما يلي:

- توفير خدمة متميزة وبمستوى المعايير الدولية والإفادة من المعرفة والخبرة القائمة في العمل.

-

تأسيس علاقات متينة مبنية على الثقة واحترام مصالح وأهداف العملاء والأطراف ذوي العلاقة وفريق العمل.

-

توفير أكبر نسبة ممكنة من التواصل مع السوق.

-

توفير أسعار منافسة.

إن خدمات بيمو السعودي الفرنسي المالية مقرونة مع خدمات الشركة الأم (بنك بيمو السعودي الفرنسي) ومصممة لتضع علامة بيمو السعودي الفرنسي كمرجع وحيد لجميع الاحتياجات المالية والاستثمارية من خلال توفير جميع هذه الخدمات ضمن منصة واحدة يسهل التعامل معها.

القيم

تلتزم بيمو السعودي الفرنسي المالية بالقيم الأساسية وهي:

- رضى العملاء.

- النزاهة.

- الشفافية.

- الامتثال للأنظمة والقوانين.

تكمن مكانة بيمو السعودي الفرنسي المالية بخبرة مؤسسيها واتساع شبكتهم والموارد التي يوفرونها:

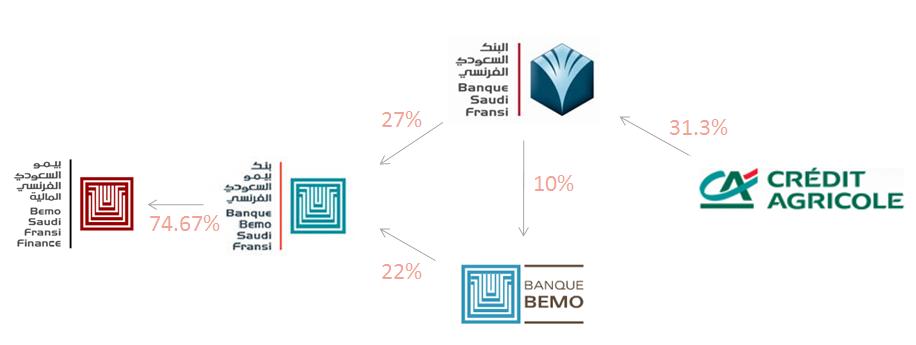

بنك بيمو السعودي الفرنسي (74.67%)

بدأ بنك بيمو السعودي الفرنسي أعماله في 4 كانون الثاني 2004 كأول بنك خاص في سوريا منذ أربعين عاماً، إن كبار مساهمي بنك بيمو السعودي الفرنسي هم الشركاء المؤسسين، البنك السعودي الفرنسي بنسبة 27%، بنك بيمو لبنان بنسبة 22% علماً أن 51.1% من الأسهم يملكها مستثمرون سوريون بنسب مختلفة. وتعتبر عائلة عبجي من كبار مساهمي بنك بيمو السعودي الفرنسي (بنسبة 6.36%) كمواطنين سوريين بالإضافة لكونهم كبار مساهمي بنك بيمو لبنان.

بنك بيمو السعودي الفرنسي هو بنك شامل في العمليات المصرفية التجارية والخاصة بالشركات وخدمات التجزئة الفردية كما يتمتع بأكبر شبكة من الفروع بين البنوك الخاصة في سوريا.

مجموعة الفاضل (25%)

مجموعة الفاضل تضم مجموعة شركات رائدة ولديها أنشطة متنوعة في منطقة الشرق الأوسط. تركز المجموعة على قطاعات استراتيجية مثل خدمات الأقمار الصناعية ومعالجة المياه والبيئة. تأسست في عام 1966 من قبل رئيس مجلس إدارتها السيد أديب الفاضل.

تمتلك مجموعة الفاضل محفظة استثمارات متنوعة لتشمل حصصاً في مؤسسات كبيرة كبنك بيمو السعودي الفرنسي وشركة الاتحاد التعاوني للتأمين. أما فيما يتعلق بالنشاط المالي للمجموعة فهي تتضمن مساهمات بارزة في مؤسسات مالية محلية ودولية.

قامت شركة جينيرشن ألفا Generation ALFA بسنة 2012 ببيع جميع أسهمها في شركة بيمو السعودي الفرنسي المالية والبالغة 300,000 سهم إلى مجموعة الفاضل بحيث أصبحت مجموعة الفاضل تملك 750,000 سهم من أسهم الشركة.

الدكتور رياض عبجي (0.167%)

الدكتور رياض عبجي هو رئيس مجلس إدارة بنك بيمو لبنان كما أنه عضو مجلس إدارة بنك بيمو السعودي الفرنسي وبنك بيمو أوروبا في لوكسمبورغ، لديه خبرة واسعة في إدارة المصارف والأعمال التجارية تعود لأوائل الثمانينيات.

الدكتور عبد الرحمن العطار (0.167%)

الدكتور عبد الرحمن العطار هو رئيس مجموعة العطار، وهي مجموعة شركات سورية تعمل في قطاعات التجارة، الزراعة، الصناعة، السياحة، المقاولات والطبابة بالإضافة إلى قطاعات أخرى داخل وخارج القطر.

السيد بسام معماري

رئيس مجلس الإدارة - ورئيس مجلس إدارة بنك بيمو السعودي الفرنسي ومساهم رئيسي فيه ورئيس مجلس إدارة بنك الائتمان الأهلي، حاصل على شهادة بكالوريوس في إدارة الأعمال، ويتمتع بخبرات وكفاءات مهنية عالية في مجال الأعمال التجارية والمالية.

السيد اندره لحود

نائب رئيس مجلس الإدارة ممثل لبنك بيمو السعودي الفرنسي – والرئيس التنفيذي بالتكليف لبنك بيمو السعودي الفرنسي، لديه أكثر من 39 سنة من الخبرة المصرفية في الإدارة المالية والتدقيق الداخلي وإدارة الفروع والتجزئة والعديد من الأقسام، انضم إلى بنك بيمو السعودي الفرنسي عام 2004.

السيد جود بدره

عضو مجلس إدارة في بيمو السعودي الفرنسي المالية، مدير عام مساعد - تكنولوجيا المعلومات، الخدمات الرقمية وعلاقات المنظمات غير الحكومية في بنك بيمو السعودي الفرنسي حائز على بكالوريوس في التجارة اختصاص مالية واقتصاد من جامعة كونكورديا (كندا) وهو حاصل على شهادة محلل مالي معتمد CFA وشهادات من كلية التعليم التنفيذي بجامعة هارفارد (الولايات المتحدة) من ضمنها التكنولوجيا المالية.

الشركات الحليفة

الشركات الحليفة الأخرى:

إنجازات

- أفضل شركة استثمار في سورية لعام 2008 – من مجلة EMEA

Finance.

Finance. - أفضل شركة استثمار في سورية لعام 2009 – من مجلة EMEA Finance.

- أفضل شركة استثمار في سورية لعام 2010 – من مجلة EMEA Finance.

- أفضل شركة استثمار في سورية لعام 2011 – من مجلة EMEA Finance.

- أفضل شركة وساطة مالية في سورية لعام 2009 – من مجلة W

orld Finance.

orld Finance. - الأولى في تقديم خدمات إدارة الأصول للأسهم في سوق دمشق للأوراق المالية (أيار 2011).

- الأولى في تنفيذ عملية شراء أسهم في تاريخ سوق دمشق للأوراق المالية (آذار 2009).

- عضو رقم 1 في مركز المقاصة والحفظ المركزي.

- عضو رقم 1 في سوق دمشق للأوراق المالية.

الشركات العملاء

لتحميل البيانات المالية ، يرجى الضغط على الروابط التالية: